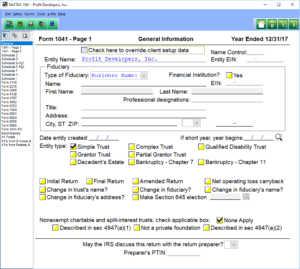

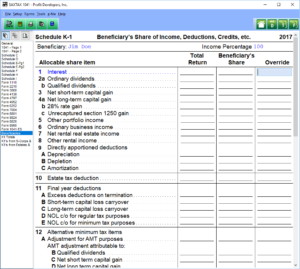

Our 1041 Program (Estates and Trusts) features easy data entry and the automatic calculations of beneficiary allocations and the ability to override these calculations. The K-1 screen for each beneficiary shows totals for the return and the beneficiary’s share of each total.

The program automatically allocates expenses against tax exempt income and calculates DNI and the distribution deduction. Because of the complexities of estate and trust income taxation, you always have the ability to override calculations for special situations.

Integrated into the 1041, SAXTAX depreciation handles Form 4562, Form 4797 and calculates depreciation for up to six different depreciation “books”: (1) regular taxes; (2) alternative minimum taxes; (3) ACE; (4) Internal (financial reporting); (5) State; and (6) Other (user definable). The normal cost of our Depreciation Program is $199, but it comes Free with the purchase of our 1041 Program.

Download a Demo or Order the 1041 Program now.

Click on the Thumbnails below to view sample program screens.

1041 Program Features

|

|

1041 Forms

| Form 1041 | Form 4797 | Form 8948 | Schedule I |

| Form 1041-ES | Form 4952 | Form 8949 | Schedule J |

| Form 1041-T | Form 6252 | Form 8960 | Schedule K-1 |

| Form 1116 | Form 7004 | Schedule C | Letters to beneficiaries and grantor(s) |

| Form 2210 | Form 8801 | Schedule D | |

| Form 2758 | Form 8824 | Schedule E | |

| Form 3800 | Form 8826 | Schedule F | |

| Form 4562 | Form 8879F | Schedule H |