SAXTAX makes preparing individual income tax returns easy – from the simplest returns with no more than W-2’s and itemized deductions to the most complicated with investment interest, alternative minimum tax and passive activities.

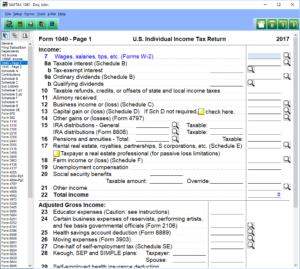

Our easy to use data entry screens are facsimiles of the actual forms (see thumbnail below), and with each entry the entire return is recalculated and totals displayed. When you are done with a return, check our diagnostics for missing data or inconsistencies in the return, then efile it, or print it for your client along with your customized transmittal letter and bill.

Integrated into the 1041, SAXTAX depreciation handles Form 4562, Form 4797 and calculates depreciation for up to six different depreciation “books”: (1) regular taxes; (2) alternative minimum taxes; (3) ACE; (4) Internal (financial reporting); (5) State; and (6) Other (user definable). The normal cost of our Depreciation Program is $199, but it comes Free with the purchase of our 1040 Program.

Download a Demo or Order the 1040 Program now.

Click on the Thumbnails below to view sample program screens.

1040 Program Features

|

|

1040 Forms

- Form 1040

- Form 1040ES

- Form 1040NR

- Form 1040X

- Form 1045

- Form 1045A

- Form 1045B

- Form 970

- Form 982

- Form 1116

- Form 1310

- Form 2106

- Form 2210

- Form 2350

- Form 2441

- Form 2555

- Form 3115

- Form 3468

- Form 3800

- Form 3903

- Form 4136

- Form 4137

- Form 4255

- Form 4562

- Form 4684

- Form 4797

- Form 4835

- Form 4868

- Form 4952

- Form 4972

- Form 5329

- Form 5405

- Form 5695

- Form 5884

- Form 5884A

- Form 6198

- Form 6251

- Form 6252

- Form 8283

- Form 8332

- Form 8379

- Form 8396

- Form 8453

- Form 8582

- Form 8586

- Form 8606

- Form 8615

- Form 8801

- Form 8814

- Form 8815

- Form 8824

- Form 8826

- Form 8829

- Form 8833

- Form 8839

- Form 8844

- Form 8845

- Form 8846

- Form 8862

- Form 8863

- Form 8867

- Form 8880

- Form 8881

- Form 8882

- Form 8885

- Form 8889

- Form 8903

- Form 8915A

- Form 8915B

- Form 8917

- Form 8919

- Form 8936

- Form 8941

- Form 8960

- Form 8962

- Schedule A

- Schedule B

- Schedule C

- Schedule D

- Schedule E

- Schedule EIC

- Schedule F

- Schedule H

- Schedule R

- Schedule SE

- Schedule 8812

1040 Worksheets

| Self-Employed Health Insurance Deduction Worksheet | Deduction for Exemption Worksheet | Schedule D Capital Loss Worksheet |

| Social Security Worksheet | Form 8582 Worksheet | Schedule D 1250 Gain Worksheet |

| IRA Deduction Worksheet | Child Tax Credit Worksheet | Schedule D Tax Worksheet |

| Student Loan Interest Deduction Worksheet | EIC Worksheet A | Qualified 5-Year Gain Worksheet |

| Standard Deduction Worksheet for Dependents | EIC Worksheet B1/B2 | Estimated Tax Worksheet |

| Tax Worksheet for Certain Dependents | Simplified method worksheet | Child tax credit pub (pub 972) |

| Foreign Earned Income | Earned Income | Shared Responsibility |

| EIC Investment Income | Medical Expenses | Insurance Premiums |

| 28% gain | Qualifying dividends | 2 year and 4 year comparison reports |