Our 8849 Claim for Refund of Excise Taxes Program is used to request refunds for prior year 2290 and prior quarter 720 returns.

If there is an abundance of credits that accumulate during the year/quarter, these schedules are used to request a refund:

Form 8849 Schedules Used To Request Refunds

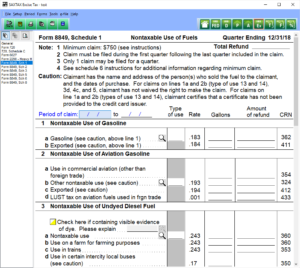

| Form 8849 Schedule 1 – Nontaxable Use of Fuels |

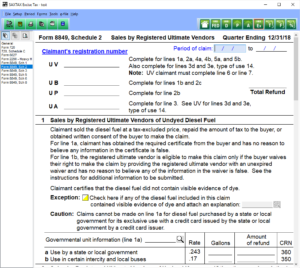

| Form 8849 Schedule 2 – Sales by Registered Ultimate Vendors |

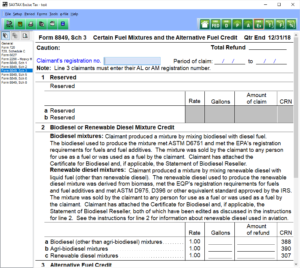

| Form 8849 Schedule 3 – Certain Fuel Mixtures and the Alternative Fuel Credit |

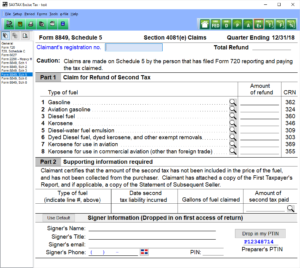

| Form 8849 Schedule 5 – Section 4081(e) Claims |

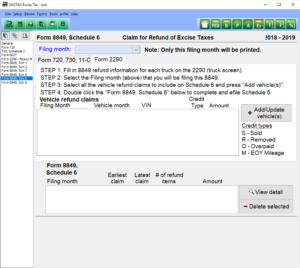

| Form 8849 Schedule 6 – Other Claims |

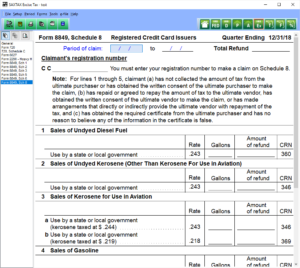

| Form 8849 Schedule 8 – Registered Credit Card Issuers |

The Excise Tax Program includes Form 8849 Claim for Refund of Excise Taxes along with Form 2290 Heavy Vehicle Use Tax and Form 720 Quarterly Federal Excise Tax Return.

Download a Demo or Order the 8849 Program now.

Click on the Thumbnails below to view sample program screens

8849 Program Features

|

|